Today, the Oriental Land Company held its annual fiscal year results meeting for FY2020, and as expected, results were not great at best due to the major impacts of the COVID-19 pandemic and fluctuating restrictions surrounding theme parks in Japan. During the last fiscal year, the Oriental Land Company posted its first annual loss since public trading began in 1996.

Net sales across the company plummeted 63.3% to ¥170.5 billion, about $1.565 billion, from ¥464.4 billion, about $4.26 billion, in FY2019. As such, the Operating Losses of the Oriental Land Company totaled ¥45.9 billion yen, about $421.3 million, in the last fiscal year, most of which came from the two theme parks.

Attendance was down 73.9% year over year as well, at 7.56 million total Guests, down from 29.01 million in FY2019. This can largely be attributed to not only the four month temporary closure last year (including during key holiday periods such as spring break and Golden Week), but also the fluctuating capacity restrictions. Park capacity was reportedly as high as 66% in December and January before dropping to 5000 Guests per day, estimated to be around 5-7% park capacity, during the second State of Emergency. In spite of this, Net Sales per Guest increased 17.5% to ¥13,642, approximately $125.22. This is largely due to the lack of Annual Passports, a sharp price increase in tickets, and a demand for merchandise and food surrounding the park reopening and the New Fantasyland expansion.

Forecasted results for Net Sales and attendance set back in Q3 were also missed due to the second State of Emergency severely limiting park capacity. However, losses were less than expected across the board, as well as Net Sales per Guest exceeding expectations.

Decrease in personnel expenses, maintenance, and energy costs in particular lead to lower losses than expected.

Major initiatives to reduce cash outflow, including reduction of Executive compensation and winter bonuses, a hiring freeze on new Cast Members, suspension of entertainment programs and special events, and reviews on maintenance operations, all lead to higher reduction amounts than anticipated. Less urgent remodeling and maintenance jobs have been downsized or postponed to FY2021 (which ends 3/22).

The 2020 Medium-term plan’s end goals set in 2018 were largely unable to be met due to circumstances surrounding the COVID-19 pandemic. However, it’s important to note that Guest Satisfaction remained very high before the pandemic, and many goals were still met including the opening of Soaring: Fantastic Flight and the New Fantasyland expansion, renovations of service facilities and the introduction of the Tokyo Disney Resort App, more flexibility for employees and Cast Members, and continued financial stability (including continued investment in future growth, such as in the upcoming Fantasy Springs expansion at Tokyo DisneySea) in spite of the COVID-19 pandemic.

A number of measures were implemented to combat challenges presented by the COVID-19 pandemic.

In their outlook for FY2021 (ending March 2022), the Oriental Land Company declined to give a detailed financial forecast at present for how this year will proceed, given the continued uncertainty surrounding COVID-19 restrictions in Urayasu City, Chiba Prefecture, and Japan in general. However, the aim is to continue ensuring peace of mind and Guest safety amid the pandemic by implementing rigorous infection countermeasures and attendance limits, enhance cost efficiency in line with attendance levels and scrutinize non-essential/urgent costs, project capital expenditure to be in the ¥130bn ($1.19bn) range (amid construction on Fantasy Springs and the Toy Story Hotel), minimize depreciation of tangible assets at Tokyo Disneyland, and prepare capital resources going forward.

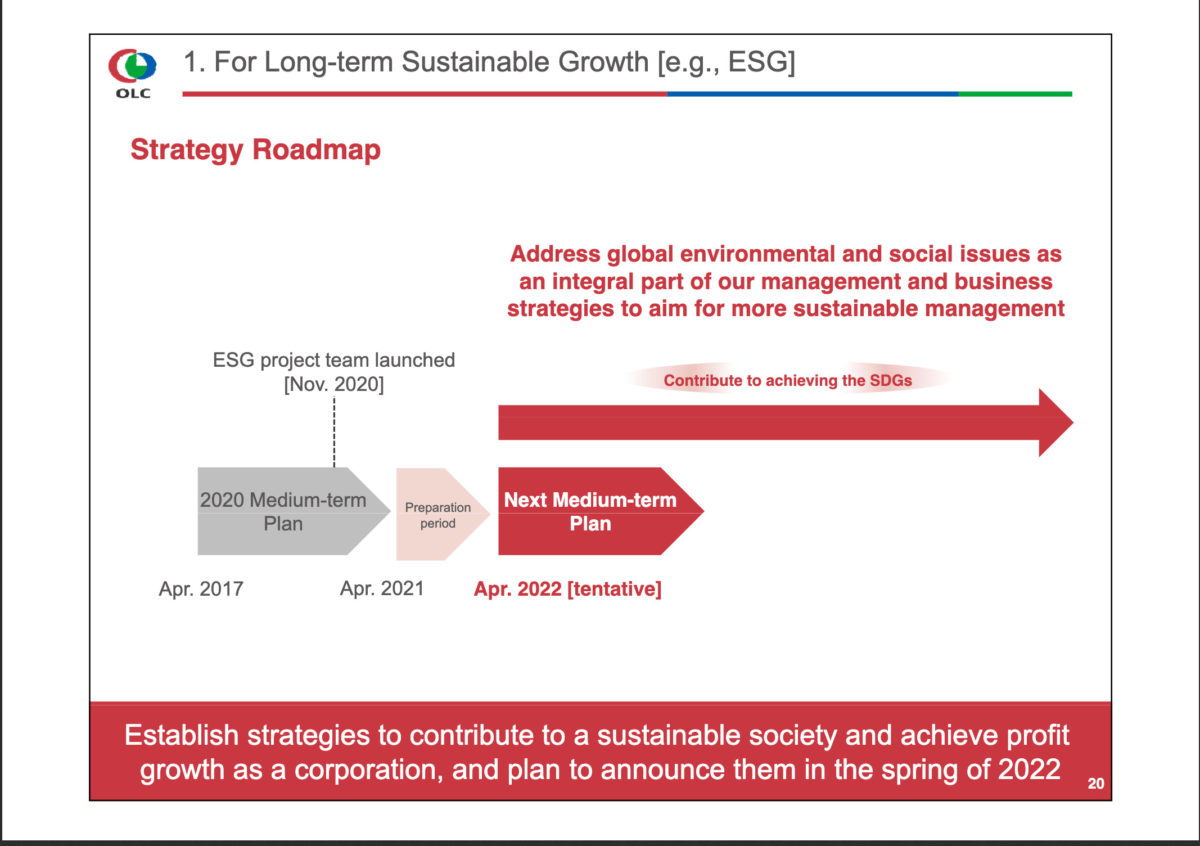

With the end of the 2020 Medium-Term Plan this fiscal year, the Oriental Land Company intends to take this year to prepare its next Medium-Term Plan with a focus on returning to profitability and contributing to a sustainable society. The next plan is aimed to be announced at the end of FY2021 in April 2022.

For long-term sustainable growth, the Oriental Land Company laid out their business strategies and risks identified both before and during the COVID-19 pandemic, and gave vague ideas for the future directions of their businesses.

One of the main goals long-term is to be more environmentally friendly, including a 40% reduction on FY2018 greenhouse gas emissions by 2030, and achieving net zero emissions by 2050, as well as adapting to climate change (a particular risk since Tokyo Disney Resort lies on low land directly on Tokyo Bay).

The resort only reported profitability in its third quarter this year, with Q1 resulting from the parks being closed entirely and Q4 a result of the second State of Emergency. OLC actually lost more money keeping the parks open at 5000 Guests during most of Q4 compared to having them closed in Q1.

While it was near impossible to expect the Oriental Land Company to emerge unscathed during the first year of the pandemic, we can only hope that they are able to return to profitability soon. With highly-infectious variants of COVID-19 spreading around Japan and barely 1% of the population vaccinated, however, it looks like there’s still a long road left for the Tokyo Disney Resort operator this year. Time will tell how OLC weathers the storm.